Product depreciation calculator

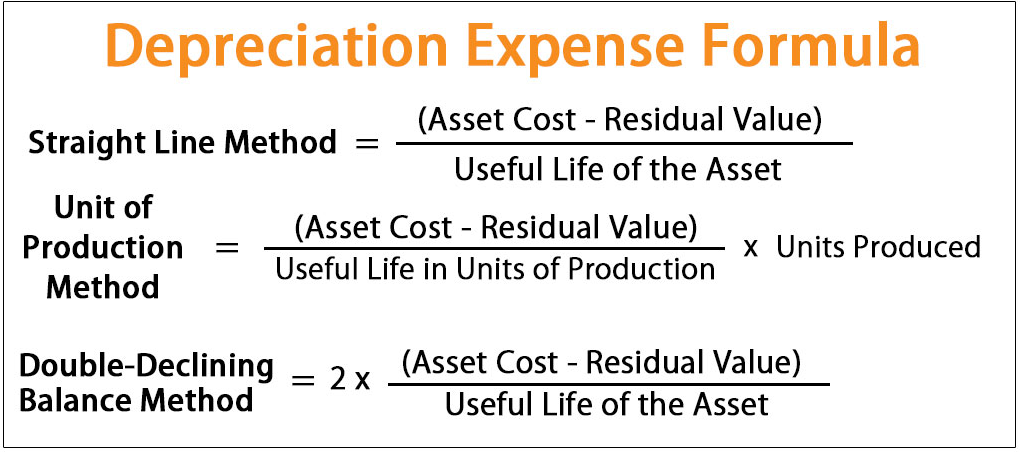

This is an easy to use depreciation calculator template that can give you the annual depreciation rates and book values using straight-line double. Units of Production Depreciation Asset cost - Salvage value Units units X Units produced Calculating unit of production depreciation manually can be hectic and time consuming.

Depreciation Formula Calculate Depreciation Expense

This simple depreciation calculator helps in calculating depreciation of an asset over a specified number of years using different depreciation methods.

. Explore ratings reviews pricing features and integrations offered by the Fixed Asset Management. Instant download Professional design easy to use Fully editable Compatible with Excel 2010 and later Support available Ready to use. Percentage Depreciation Calculator Asset Value Percentage Period Results The calculator uses the following formulae.

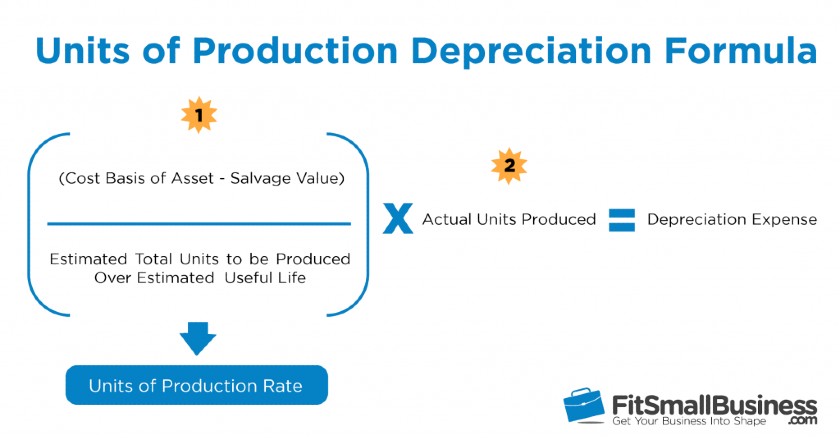

Depreciation means the products future value is less than the original value. Depreciable Base 750225 - 25000 725225 Depreciation per Unit gross 725225 255626 Units 03626unit rounded to 4 decimal places Depreciation for Period 03626. First one can choose the.

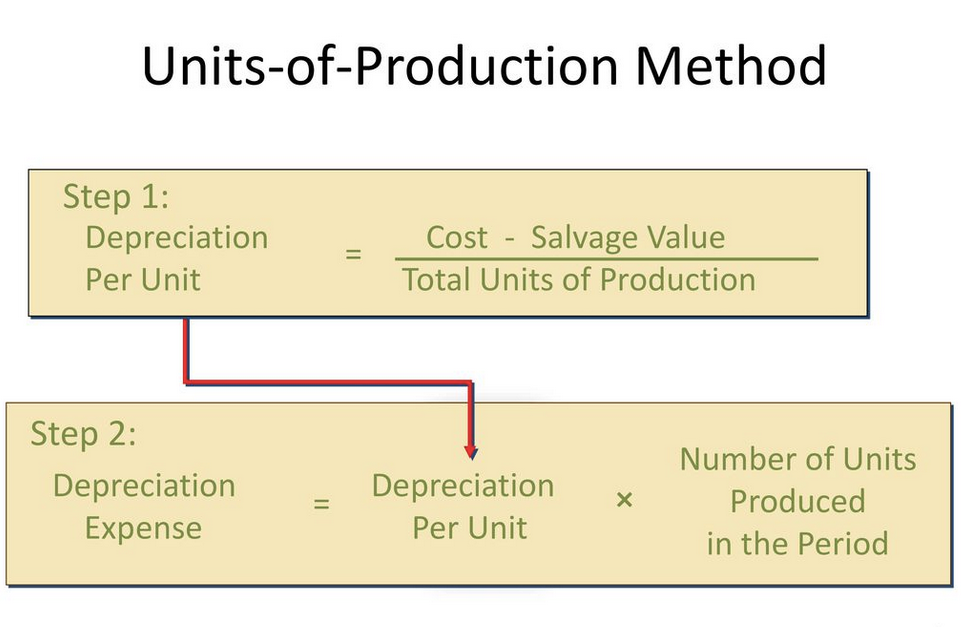

Unit of Production Depreciation Depreciable Value Actual Number of Units. Depreciation Calculators Depreciation calculators online for primary methods of depreciation including the ability to create depreciation schedules. Find a Dedicated Financial Advisor Now.

Depreciation amount 5000 x 20 1000 Decreasing Balances Method The netbook value per year is taken as a basis not the purchase. Depreciation Calculator user reviews from verified software and service customers. An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today.

Depreciation Calculator This depreciation calculator is for calculating the depreciation schedule of an asset. The calculator allows you to use. The formula of the depreciation and appreciation is the same rates are either below zero depreciation or above.

It provides a couple different methods of depreciation. Depreciation per year Book value Depreciation rate Under this system a fixed percentage of the diminishing value of the asset is written off each year so as to reduce the asset to its. The fundamental way to calculate depreciation is to take the assets price minus.

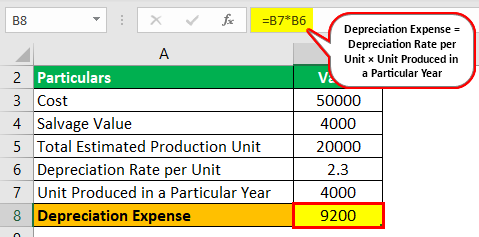

Depreciation Expense Total Depreciation 9200 Value of Asset after Depreciation 50000-9200 40800 Suppose in 2nd year the said equipment used 8000 hours then the. Depreciation Calculator Depreciation Calculator The calculator should be used as a general guide only. There are many variables which can affect an items life expectancy that should be taken.

Depreciation Amount Asset Value x Annual Percentage Balance. The depreciation rate 15 02 20. Non-ACRS Rules Introduces Basic Concepts of Depreciation.

Ad Do Your Investments Align with Your Goals. The Formula for calculating depreciation using the unit of production method is as follows. Also includes a specialized real estate.

The depreciation method is a way to spread out the cost of a long-term business asset over several years. Basic Tax Depreciation Overview Including Depreciation Methods Accounting Procedures.

Depreciation Formula Calculate Depreciation Expense

Unit Of Production Depreciation Method Formula Examples

Depreciation Formula Calculate Depreciation Expense

Depreciation Rate Calculator Cheap Sale 60 Off Www Ingeniovirtual Com

Depreciation Formula Examples With Excel Template

Depreciation Formula Examples With Excel Template

Depreciation Calculator

Unit Of Production Depreciation Method Formula Examples

How Do I Calculate Depreciation Formula Guides Examaples

Depreciation Expense Calculator Factory Sale 50 Off Www Ingeniovirtual Com

Calculating Depreciation Unit Of Production Method

Depreciation Expense Calculator Discount 56 Off Www Ingeniovirtual Com

Depreciation Formula Examples With Excel Template

Depreciation Expense Calculator Discount 56 Off Www Ingeniovirtual Com

Units Of Production Depreciation Calculator Double Entry Bookkeeping

Depreciation Formula Calculate Depreciation Expense

Depreciation Formula Calculate Depreciation Expense